Franklin Bissett All Canadian Focus Fund is a two-time

Fundata A+™ Award winner, most recently in 2015. It is on track for another excellent year with a September 2016

FundGrade™ Rating of B and a year-to-date return of 10.6% as of Sept. 30, which incidentally also marks the end of its twelfth calendar year since inception. Besides performance credentials, this fund is remarkable for another reason: For most of its recent history, it has been nearly 100% invested in Canadian equities, with a large-cap bias. I applied a technique called Returns Based Style Analysis (RBSA) to capture a statistical picture of the fund manager’s style.

The Returns Based Style Analysis technique was developed by Nobel prize-winning economist William F. Sharpe and is a robust tool that is used to describe the style used by a portfolio manager. The idea is to build a custom benchmark portfolio that describes a manager’s investing style. The portfolio weights are generated by a regression of fund returns on those of a mutually exclusive set of indices, with each index representing distinct sources of risk. Usually this means a selection of bond and stock indices that cover some portion of the market with minimal overlap.

The consistency and simplicity of the Franklin Bissett All Canadian Focus Fund security selection makes it an excellent candidate for a sector-focused variation of RBSA.

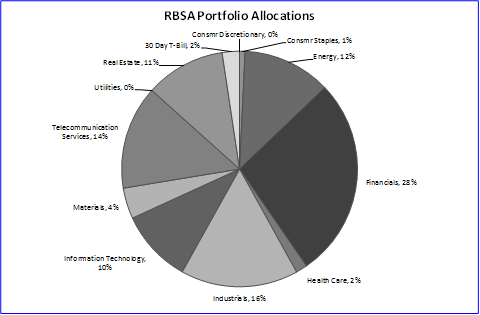

For Franklin Bissett All Canadian Focus Fund, the relevant section of the market is limited, providing an opportunity to use RBSA for a closer look at a single asset class. For this purpose, a set of 12 Canadian equity sector indexes, represented by the S&P/TSX Composite Sector Indices, and the cash-equivalent 30-day Canadian Treasury Bill Rate, were used. Additional inputs included 36 months of Series A returns and a “no short-selling” constraint. The RBSA generated the portfolio illustrated in the graph below:

Based on the RBSA portfolio, the Franklin Bissett All Canadian Focus Fund looks to be well diversified across the various sectors of the Canadian economy. The main focus for the last 36 months has been on Financials, Industrials and Telecommunications, perhaps indicating a defensive stance in the face of the decline in oil prices and weakness in the dollar. These results are interesting and informative, but how accurate are they?

Accuracy of RBSA

Comparing the RBSA portfolio allocations to the current sector allocations of the Franklin fund reveals some interesting similarities, most notably across sectors that are more likely to be consistent between Fundata’s sectors and the scheme used by the benchmark indices. Specifically, allocations in Financial Services, Energy, and Basic Materials as of June 30, 2016, differ by about one percentage point from the RBSA portfolio allocations.

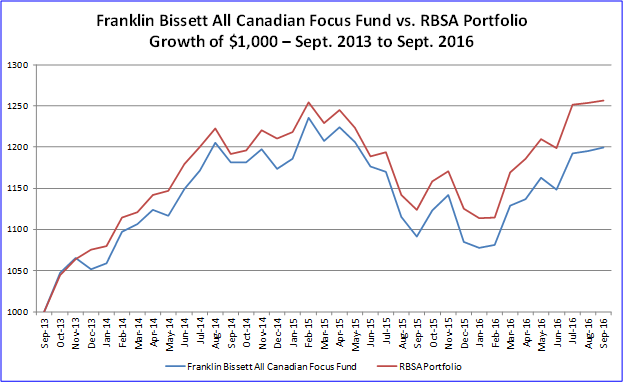

Furthermore, a simple linear regression of the fund’s monthly returns on the RBSA portfolio’s returns indicates that RBSA predicts 93% of the variation in monthly returns. The power of this tool cannot be overstated. Without any reference to the fund’s holdings, RBSA has taken a set of monthly returns and translated them into a portfolio with defined allocations that explains 93% of the performance of the Franklin Bissett All Canadian Focus Fund. Comparing the growth of $1,000 for the two funds in the graph below confirms this result:

The returns of RBSA closely track the realized returns of the Franklin Bissett fund, differing by less than five percentage points in the final month.

Using RBSA to build custom benchmarks

Beyond the manager’s style, RBSA can be used to build a custom benchmark. With occasional adjustments, investors could use a portfolio similar to the one above to measure against the performance of a fund and analyze a manager’s contribution to performance via security selection (alpha). Another possible use involves combining the RBSA weights with estimates of the expected return of the indices to forecast future returns of the fund under analysis.

Of course, extrapolating performance into the future returns requires a cautious approach, beginning with proper specification of the model. Selection of reference indices and length of history will have a significant impact on the outcome. Even if robust results are obtained, the potential outcome would have to be carefully weighed against the ease of execution and transactions costs.

In sum, Returns Based Style Analysis is a very useful tool for evaluating a manager’s style, including monitoring changes and drift over time. As we’ve demonstrated here, it has provided insight into the sector focus of the Franklin Bissett All Canadian Focus Fund without directly referencing the fund’s holdings.

John Krisko, CFA, BBA, is Senior Analyst, Analytics & Data, at Fundata Canada Inc. This article is not intended as personalized investment advice. Securities mentioned are not guaranteed, involve risk of loss, and are subject to commissions.